Hello everyone,

following the call we had yesterday May 24th, I’m kind to share in more details what I do think regarding establishing a policy for managing DBC’s treasury assuring that it’s used to follow and execute DBC’s mission and vision while looking to maximize the possibilities of benefiting from crypto-markets potential grow AND reducing the risks of it’s implied volatility.

This blog entry includes:

- a Demo Draft for what this policy might look at.

- a Role Description for a Treasury Management Facilitator.

DBC Treasury Policy - Pre (or better called, DEMO) DRAFT

The Diamante Bridge Collective (DBC) operates under sociocracy principles, emphasizing shared governance and inclusive decision-making. This document outlines the assets held in the DBC treasury, their respective weights, and the rationale behind their selection. It serves as a guide for DBC members to understand our portfolio management principles and strategies.

This Policy does not represent any proposal, neither represents the autor’s intentions, it’s just a first example of a documented policy/guideline that would help the governors or treasury council still-to-be-decided of the treasury to guide and facilitate their decision making process, it might and shall include further design principles or aspect that the DBC community would like to implement and guarantee.

I. Decision-Making Process and Principles

Our asset selection shall be grounded in market analysis, individual asset performance evaluation, and potential return on investment. Key considerations include current market conditions, risk management strategies, and portfolio diversification. The following principles guide our decision-making process:

- Development State: Determining whether DBC is in a development state (expending money) or a waiting state (collecting money) influences our portfolio composition.

- Market Condition: Adjusting the portfolio based on whether the market is bullish or bearish.

Decision Matrix:

| Market Condition\Project State | Developing | Waiting |

|---|---|---|

| Bullish | 70:30 | 50:50 |

| Bearish | 50:50 | 30:70 |

Some Notes about these principles

- The ratios indicate the distribution between blue-chip assets and stablecoins, respectively.

- The explicit ratios are just an example, the Treasury council shall discuss and agree on them.

- Blue-chip assets reffer to well established cryptocurrencies, trustworthy but still volatile like ETH, BTC, MATIC, ARB, OP; stablecoins refer to cryptocurrencies pegged and/or backed to/with USD.

- A bullish

market means where conditions are benefitioal and prices follow a raising tendency, while a bearish

market means where conditions are benefitioal and prices follow a raising tendency, while a bearish  market means the opposite, prices are low and tendencies show decreases in price.

market means the opposite, prices are low and tendencies show decreases in price. -

Besides Blu-chips and stablecoins, we could also integrate Regen assets (like cryptoassets backed or pegged to eco-logic metrics) or highly speculative assets.

Besides Blu-chips and stablecoins, we could also integrate Regen assets (like cryptoassets backed or pegged to eco-logic metrics) or highly speculative assets.

II. Portfolio Storage, Composition, Distribution, and Rationale

DBC Treasury should be stored in a community Multi-sig Wallet ([what is this? just google it, my forum permissions don’t allow me to share more than one link, sorry) with a number, and assignation of signers to be decided by the DBC sociocracy governance. Multi-sig shall be deployed in all relevant chains for DBC and the signers (addresses) shall be the same in each EVM chain, as well as identifiable (we want to know Who’s signing).

Current Portfolio Distribution:

DBC portfolio currently resides on the EOA (what is an EOA? just a regular wallet, google “External Owned Account” for more info) 0x7554f10da3ed7128300577e55abcd8f8835bcee4 that holds the following list of assets:

| Chain | Token | Price | Balance | Value |

|---|---|---|---|---|

| Arbitrum | ETH | $3,737.35 | 0.8176 | $3,055.55 |

| Optimism | ETH | $3,737.35 | 0.1246 | $465.85 |

| Optimism | USDGLO | $0.999 | 319.7 | $319.36 |

| Ethereum | ETH | $3,737.35 | 0.0763 | $285.00 |

| Optimism | OP | $2.54 | 66.9423 | $170.03 |

| Polygon | MATIC | $0.723 | 178.3595 | $128.98 |

| Arbitrum | ARB | $1.19 | 66.395 | $79.01 |

| Polygon | EARTH | $8.20 | 25.5 | $57.23 |

| BSC | KATA | $0.00121 | 37,543.211 | $45.51 |

| BSC | METAV | $0.00521 | 8,089.406 | $42.14 |

| Gnosis | XDAI | $0.999 | 23.6335 | $23.61 |

| Optimism | USDC | $1.00 | 16.55 | $16.55 |

| Optimism | USDT | $1.05 | 13.5829 | $14.21 |

| Optimism | DAI | $1.00 | 10.5 | $10.50 |

| Optimism | USDC | $0.998 | 4.75 | $4.74 |

| Gnosis | COW | $0.33 | 10 | $3.30 |

| BSC | GQ | $0.000644 | 3,747.5 | $2.41 |

| Polygon | DAI | $1.00 | 2 | $2.00 |

| Polygon | USDC | $1.00 | 1.57 | $1.57 |

| Gnosis | WETH | $3,736.33 | 0.0004 | $1.48 |

| Gnosis | FOX | $0.0802 | 12.6254 | $1.01 |

| Polygon | USDT | $1.00 | 0.9089 | $0.91 |

| BSC | BNB | $601.39 | 0.0014 | $0.82 |

| Gnosis | AGVE | $63.71 | 0.01 | $0.64 |

| Polygon | WETH | $3,736.33 | 0.000095 | $0.35 |

| Gnosis | BRIGHT | $0.0367 | 3 | $0.11 |

| Celo | CELO | $0.871 | 0.095 | $0.08 |

Total $ 4.732 USD

-

See Zapper Link for an updated list in the Agenda, again, I’m not allowed as a new user, to bring that many external links here.

See Zapper Link for an updated list in the Agenda, again, I’m not allowed as a new user, to bring that many external links here.

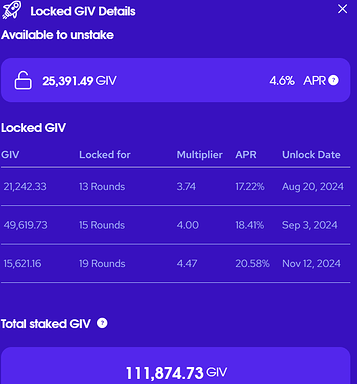

As well as a considerable amount of $GIV tokens (in the same EOA?) that are locked and/or available to claim:

IV. Risk Management

Risk management is integral to our strategy, employing the following measures:

- Diversification: We hold assets across various classes and networks to reduce risk and protect our portfolio from market volatility.

- Stablecoin Allocation: A substantial part of our portfolio might be allocated to stablecoins (USDC, DAI, xDAI, BridgeBack…) to hedge against potential downturns in the crypto market.

- Understanding Stablecoin Risks: Stablecoins like Celo Dollars (cUSD) are hybrid crypto-collateralized/seigniorage-style stablecoins. Their stability relies on the value of collateral reserves and an algorithm that adjusts supply based on demand. If cUSD demand drops more than the total value of reserves, the protocol may not contract enough supply to meet decreased demand, risking the stablecoin’s stability.

V. Emergency decisions

In the volatile and fast-paced world of crypto markets, there may arise situations where urgent decisions are required to protect the assets and interests of the Diamante Bridge Collective (DBC). This Emergency Decision Protocol will outlines the steps and authority involved in making such decisions when the Treasury Council is unable to convene in a timely manner.

Criterias, authorities and responsibilities, as well as reporting and documentation procedures shall be produced between the Treasury Management Facilitator and the Treasury Cuoncils, still to be decided and deployed.

Role Description: Treasury Management Facilitator

Position Overview:

The Treasury Management Facilitator will oversee the DBC’s treasury, ensuring alignment with our culture, financial principles and goals. This role involves guiding and educating the community about crypto assets and their management, enabling members to make informed proposals for using communal funds for cultural activities, as well as facilitating the governance decision

Key Responsibilities:

- Portfolio Management: Monitor and propose adjustments to the treasury portfolio to align with market conditions and DBC project states.

- Policy Governance Facilitation: Drive forward with a Treasury Council the Design and governance over the DBC Treasury Policy.

- Community Education: Conduct workshops and create educational materials on crypto assets, risk management, and portfolio strategies.

- Proposal Facilitation: Assist community members in drafting and evaluating proposals for utilizing communal funds.

- Reporting and Transparency: Provide regular updates on the treasury’s status and performance to ensure transparency and informed decision-making within the community.

Skills and Qualifications:

- Strong understanding of crypto markets and asset management.

- Experience in portfolio management and risk assessment.

- Excellent communication and educational skills.

- Familiarity with sociocratic governance and collective decision-making processes.

Effort Requirements:

This job might require an effort of 2-6 hours per week.

Benefits:

To be discussed.

If you read till this point, thanks A Lot!!! Now it’s your time to input comments, amendments and/or any further idea.